The Future. Over the past 13 months, rate hikes and bank collapses have led US investors to move $1 trillion out of traditional bank accounts — and put it somewhere else to make more money. That’s bad for banks but better for the rest of us.

Of interest

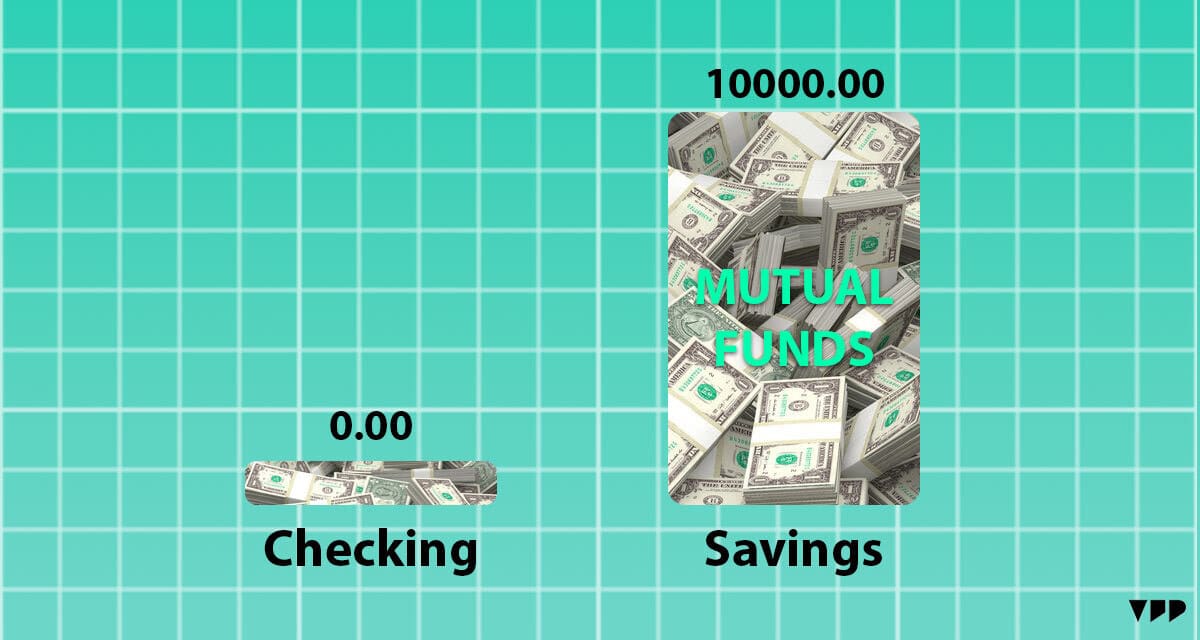

The great fiscal migration comes as investors pursue higher yields than banks offer.

- Ever since the 2008 financial crisis, the Fed has kept interest rates so low that investors had little to gain by moving their money around — until March 2022, when the Fed began raising rates to record highs.

- But the transition really started after Silicon Valley Bank collapsed; investors then moved nearly $400 billion out of commercial banks and $340 billion into money market funds in just a few weeks.

- The reason: banks pay less than .5% interest on checking and savings accounts and under .6% for their money market savings accounts. In contrast, major money market mutual funds pay 4 to 5%.

Move money to make money

Whether choosing liquid options like money market funds or high-yield Treasury bonds that require a long-term investment, many Americans have found that it’s in their best interest to relocate funds. You snooze, you lose.

TOGETHER WITH CANVA

No design skills needed! 🪄✨

Canva Pro is the design software that makes design simple, convenient, and reliable. Create what you need in no time! Jam-packed with time-saving tools that make anyone look like a professional designer.