The Future. The Securities and Exchange Commission is taking on retail trading apps with a proposed rule that would curtail all the fun and ease that make these platforms so addictive — a reaction to the Gamestonk craze that swept the internet in 2021. With the agency seeking public comment over the next few months, don’t be surprised if Reddit whips it up in a frenzy and organizes testimonies in opposition.

Under the Robinhood

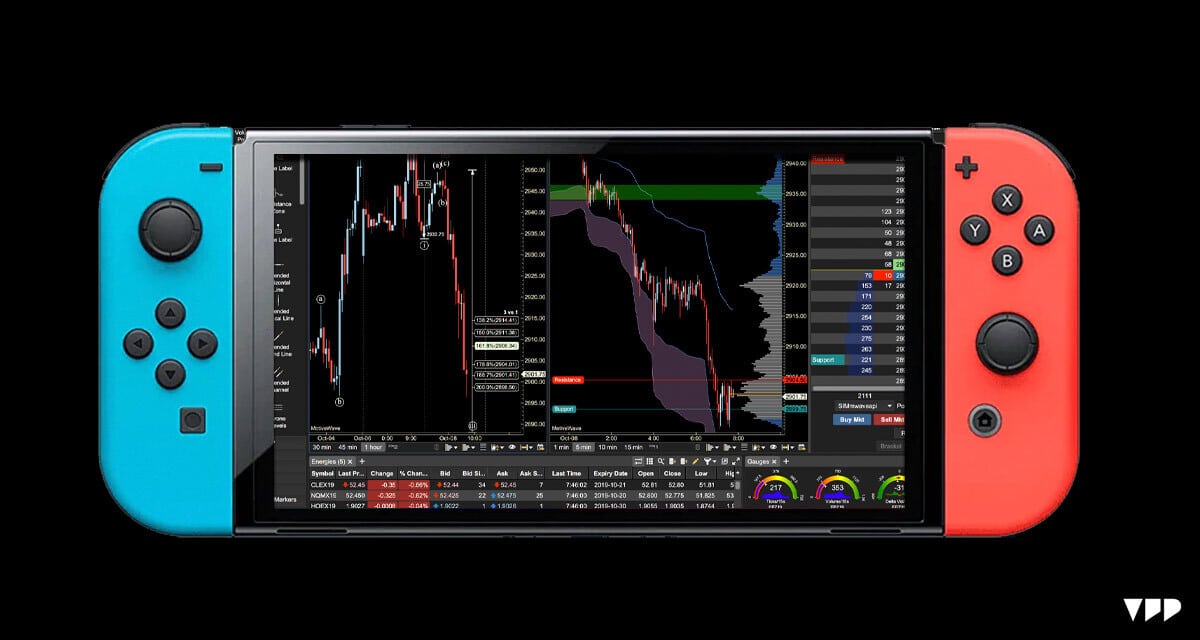

The SEC thinks platforms like Robinhood and Fidelity gamify stock trading too much.

- The SEC voted 3-2 to introduce a rule that would “hold algorithms that predict, guide, or forecast investors’ behavior, in certain cases, to a similar standard as investment advice,” per WSJ.

- What does that mean? All the bells and whistles of trading apps — including the push notifications, sounds and colors, and leaderboards — could be subject to SEC oversight.

- Why? The agency believes these create a conflict of interest that subliminally encourages users to trade more (potentially against sound investment advice), which only juices these apps’ engagement metrics and collected fees.

And with the rules also targeting “analytical tools used by investment firms to predict or direct investment-related behaviors,” expect any AI systems integrated into these platforms to be put in the hot seat.

TOGETHER WITH CANVA

No design skills needed! 🪄✨

Canva Pro is the design software that makes design simple, convenient, and reliable. Create what you need in no time! Jam-packed with time-saving tools that make anyone look like a professional designer.