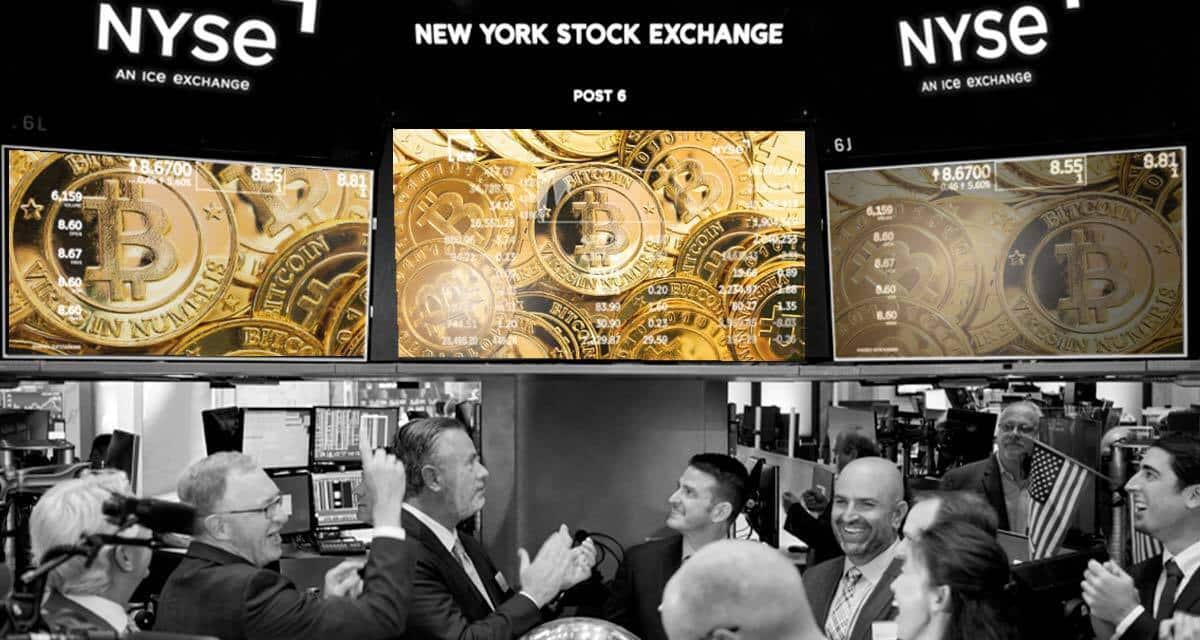

The Future. Everyday investors have started to play around with Bitcoin after the SEC begrudgingly approved the creation of Bitcoin ETFs. By removing the need for customers to sign up for jargon-riddled crypto platforms, and by adding a layer of protection through traditional asset managers, Bitcoin may have finally reached its mainstream moment.

Token investment

A lot more people might start to become HODLers.

- There was $4 billion worth of transactions across 11 new ETFs during the first day of trading.

- The financial products were available on exchanges like the Nasdaq and through major financial asset managers like BlackRock and Fidelity.

- The surge in demand briefly spiked Bitcoin’s price to a high of $49,000 (still a long way off from the crypto’s all-time high of $65,000 in November 2021).

Financial analysts note that the ETFs’ performance was impressive but people shouldn’t think too much of it just yet — it may take up to six months to truly gauge the asset’s staying power.

And with asset managers like Vanguard refusing to offer the ETFs, and the SEC still coming after the crypto industry at large, it may be two steps forward, one step back for “tokenization.”

TOGETHER WITH CANVA

No design skills needed! 🪄✨

Canva Pro is the design software that makes design simple, convenient, and reliable. Create what you need in no time! Jam-packed with time-saving tools that make anyone look like a professional designer.